Effects of Family Structure on Healthcare Coverage

Shifting marriage patterns have significantly altered the healthcare coverage of American adults. The majority of American adults (below age 65) receive health insurance through their Employer-Sponsored Coverage,1) which generally extends to legal spouses and dependent children. As cohabitation rates rise, divorce becomes more commonplace, and young adults delay or forego marriage, the percentage of Americans eligible for employer coverage has diminished.

Marriage

Married individuals are more likely to have health insurance than their unmarried counterparts.2) Likewise, children living in intact married families were least likely to have had no health insurance, according to researchers at the Center of Disease Control.3) Dr. Henry Potrykus and Dr. Patrick Fagan of the Marriage and Religion Research Institute reported that the fraction of intact families in a geographic area has the largest attenuating influence on the proportion of 25- to 54-year-olds receiving public healthcare, even after controlling for demographics, education, and earnings. The same analysis found that the fraction of intact families has the second largest influence on the proportion of 25- to 54-year-olds with private healthcare coverage.4)

Marital Disruption

Adults and children frequently lose their health insurance coverage following a marital dissolution.5) According to Bridget Lavelle and Pamela Smock of the University of Michigan, roughly 115,000 women each year lose their private health insurance due to a divorce, and more than half of these women end up uninsured.6) Women's overall rates of health insurance remained depressed for an average of two years following their divorce.7)

Foregoing Marriage

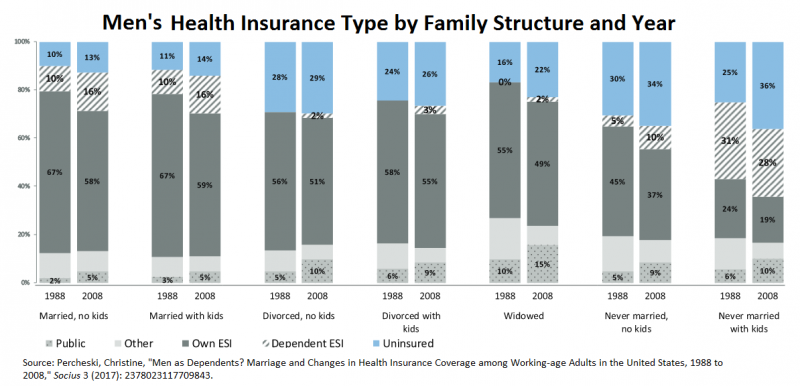

While high divorce rates tend to hurt women’s health insurance coverage, declining marriage rates hurt men’s. Young women who obtained insurance through their husband’s employer in past years now obtain insurance through their own employer, and therefore are not significantly affected by the shifts away from marriage.8) However, young men do not have any offsetting factors to supply for the benefits once supplied by marriage, and are increasingly left without their own employer coverage.9)